Time Decay and Expirations

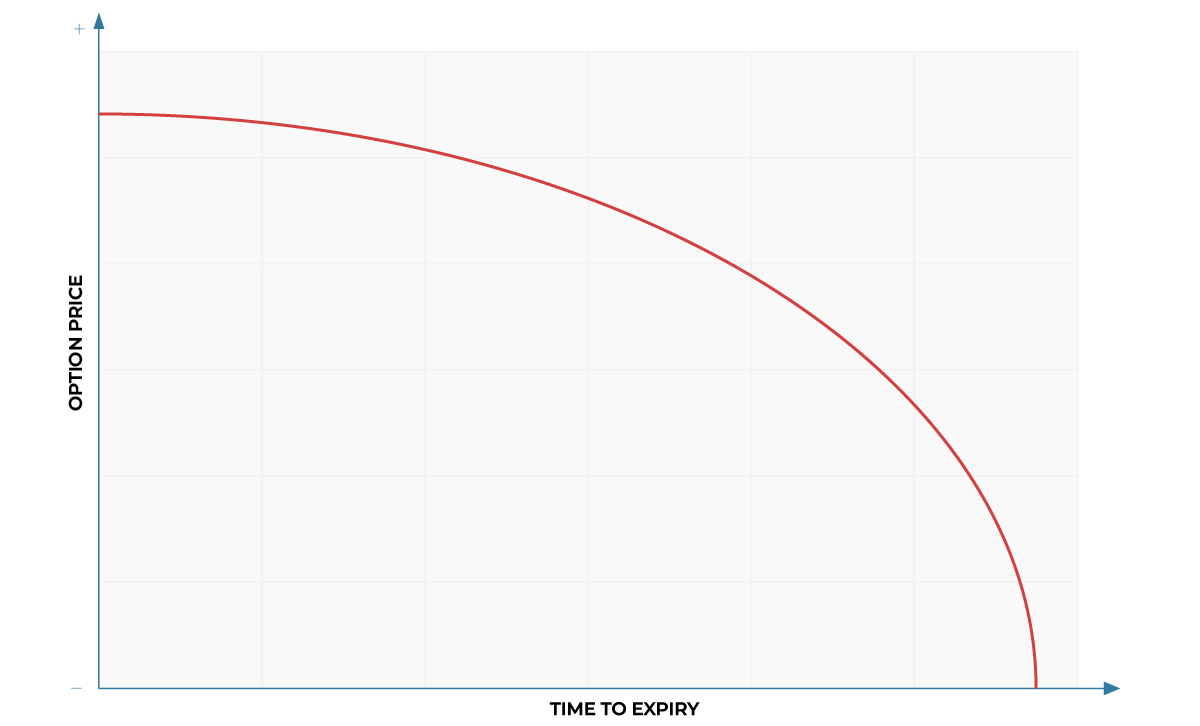

Time decay is the rate of change in value to an option’s price as it nears expiration. Depending on whether an option is in-the-money (ITM), time decay accelerates as expiration approaches. The more time left until expiry, the slower the time decay while the closer to expiry, the more time decay increases.

RULE OF THUMB (ROT) Buying contracts to close to their expiration date is more of a LOTTO play, profitability is based on immediate move of the stock one way or the other.

The expiration date for listed stock options in the United States is normally every Friday that the contract expires. On months that the Friday falls on a holiday, the expiration date is on the Thursday immediately before that Friday. Many stocks don’t have weekly expirations only monthly. Also SPX and SPY have daily expirations.

The option premium is the total amount that investors are willing pay for an options contract.

One Options Contract gives you the option to purchase 100 shares of a stock or symbol at a certain price.

We have to explain what the definitions of Time Decay and Expiration are, in order to properly execute your buy and your sell orders. Now that we know Options Contracts have expirations we can understand that they have to be traded within that expiration period.

Typically an Options Trader is looking to buy an Options Contract when the Premium is below fair value (usually when it has enough time until the expiration of that contract), and sell it when the Premium is above fair value (Sam’s model, usually when the price of the stock has reached closer to the Options Strike of the Options Contract they bought previously).

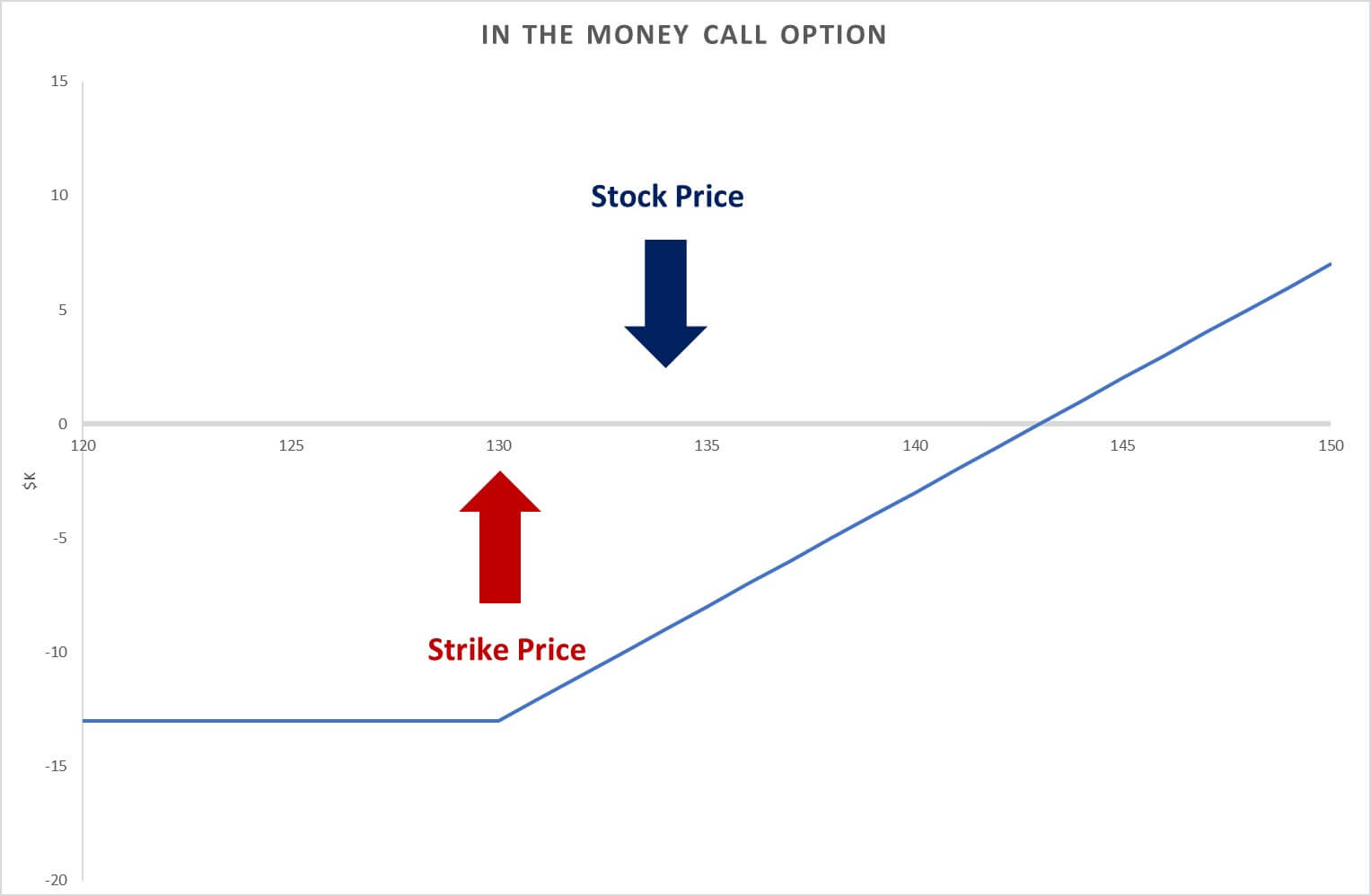

Upon the expiration of an Options Contract that is IN THE MONEY (ITM) the trader has the opportunity to exercise his Options Contract. In order to do this the trader has to have the equivalent of 100 shares of the stock multiplied by the number of contracts he bought multiplied by the strike he bought on his trading account and in return he will receive 100 shares per contract of the stock he decided to exercise. Otherwise if he does not close his trade by the end of market on expiration date the premium will deflate to $0 immediately after market close. If his contract is not IN THE MONEY that contract will have a $0 value by expiration.

Understanding Time Decay is a very important skill if you are an active Options Trader. Usually when you are buying options you are expecting either that the price of the stock will go up in case of buying CALLS or that the price of the stock will go down if you are buying PUTS. (There are other scenarios like hedging and others where this is not true but for this purpose we will assume we are doing a normal options trade).

Premium keeps rising up as the stock price gets closer and closer to the strike you chose to buy when you decided to buy either calls or puts, but it can be offset by Time Decay. As the stock grows closer to the strike, we consider this strike to be getting closer to IN THE MONEY (ITM). Being ITM means that the price of the stock reached and/or surpassed the strike you chose.

Now the problem with premium is that every day that goes by and the closer a contract gets to its expiration date, this premium deflates.

For example, If one share of a specific stock’s price is at 180.00 on a Monday and you bought CALLS (options contracts) of the 200.00 strike expiring that same Friday, you probably paid 3.00 per CALL contract (value set for example purposes), but if time goes by and it is now Wednesday and the stock has been fluctuating but at market open the stock hits 180.00 again, the value of the premium that you bought at 3.00 on Monday will probably be 1.50 on a Wednesday this is due to time decay, as it is getting closer to the expiration on Friday, TIME DECAY is deflating the value of the premium and the closer it gets to Friday at end of market the closer that premium is to go to $0, that is, if your trade is not ITM. If the trade or the stock’s price is ITM, (above 200.00) then the PREMIUM will not deflate even if it gets closer to the EXPIRATION or it does expire.

Time decay and Premium Deflation is very tricky because it accelerates the more it gets closer to the expiration. It is also exacerbated by the fluctuation in the price of the stock and how far away from being ITM it is. Plan accordingly and don’t trade anything that you are not inherently expecting it to go to $0.

FINRA DISCLOSURE

Day trading can be extremely risky…You should be prepared to lose all of the funds that you use for day trading. In particular, you should not fund day-trading activities with retirement savings, student loans, second mortgages, emergency funds, funds set aside for purposes such as education or home ownership, or funds required to meet your living expenses. Further, certain evidence indicates that an investment of less than $50,000 will significantly impair the ability of a day trader to make a profit. Of course, an investment of $50,000 or more will in no way guarantee success.

0 Comments